At-Fault vs No-Fault Car Accidents: What You Need to Know

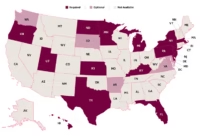

Understanding the difference between at-fault and no-fault car accidents can save you time, money, and headaches if you ever find yourself in a collision. Let’s break it down in a friendly, conversational way. What’s an At-Fault Accident? In most states, if you’re involved in an accident, one driver is usually deemed at-fault. This means that… Read More »